Renters Insurance in and around Asheboro

Welcome, home & apartment renters of Asheboro!

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

- Asheboro

- Greensboro

- Winston Salem

- Albermarle

- Fuquay Varina

- All of NC

Home Sweet Home Starts With State Farm

Your rented house is home. Since that is where you make memories and spend time with your loved ones, it can be beneficial to make sure you have renters insurance, whether or not your landlord requires it. Even for stuff like your pots and pans, boots, hiking shoes, etc., choosing the right coverage can help protect you from the unexpected.

Welcome, home & apartment renters of Asheboro!

Rent wisely with insurance from State Farm

State Farm Has Options For Your Renters Insurance Needs

It's likely that your landlord's insurance only covers the structure of the apartment or property you're renting. So, if you want to protect your valuables - such as a tool set, a set of favorite books or a bed - renters insurance is what you're looking for. State Farm agent Lisa Blackwell can help you evaluate your risks and insure your precious valuables.

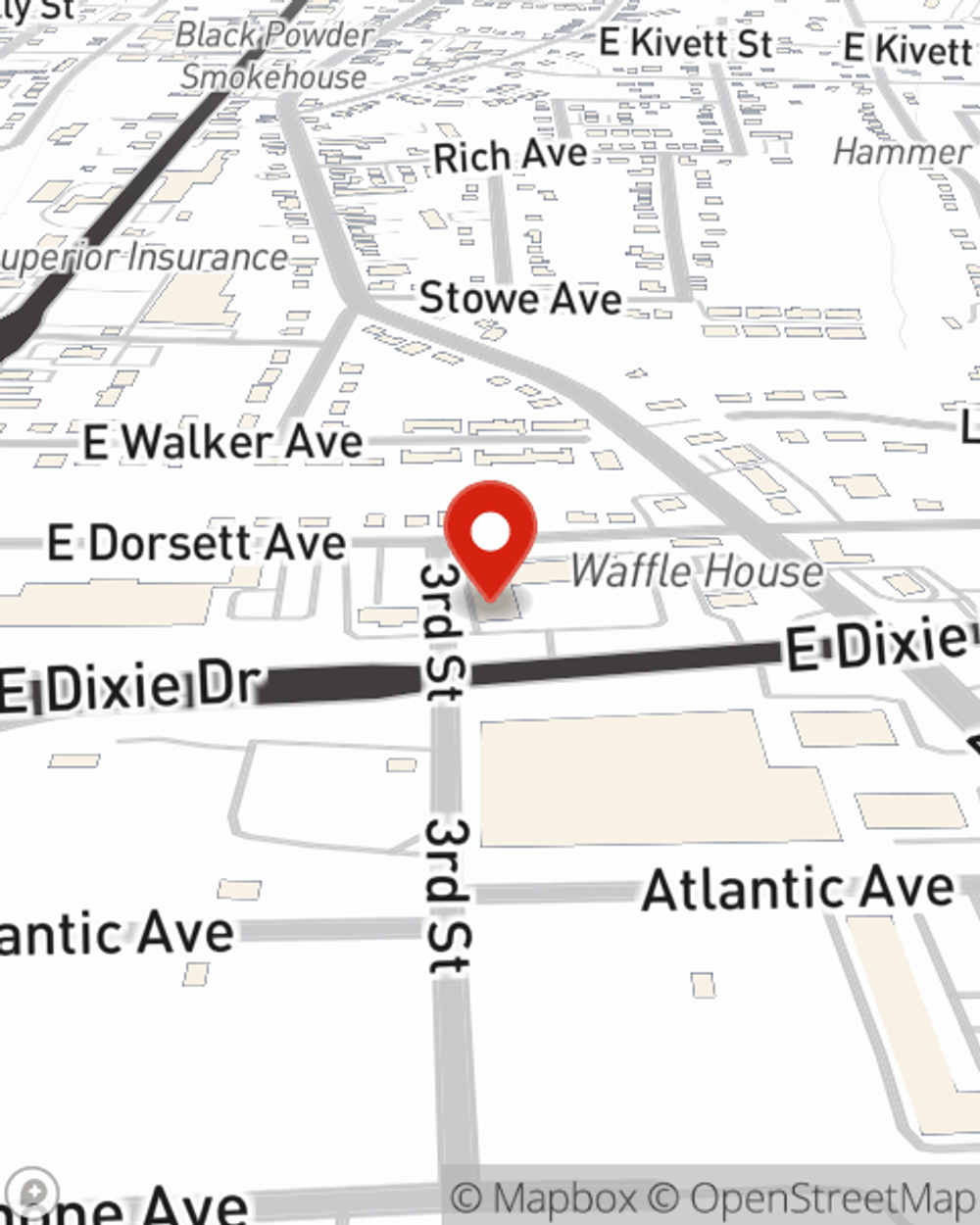

A good next step when renting a home in Asheboro, NC is to make sure that you're properly covered. That's why you should consider renters coverage options from State Farm! Call or go online today and learn more about how State Farm agent Lisa Blackwell can help meet your renters insurance needs.

Have More Questions About Renters Insurance?

Call Lisa at (336) 625-4300 or visit our FAQ page.

Simple Insights®

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Lisa Blackwell

State Farm® Insurance AgentSimple Insights®

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.